Mergers from a Position of Strength: A Bold Opportunity for Today’s Nonprofits

In today’s fractured political and funding landscape, many nonprofits — especially small and mid-sized organizations — are struggling to maintain services, retain staff, and keep the lights on. While this reality is daunting, it also creates a powerful and underleveraged opportunity for larger, healthy nonprofits: to strategically merge with or absorb smaller peers, not from a place of distress, but from a place of purpose and strength.

At La Piana Consulting, we have long supported nonprofits in navigating strategic partnerships, mergers, and other alliances. And while we’ve worked with many organizations in crisis, some of the most successful and mission-expanding mergers we’ve facilitated were initiated by strong, well-resourced nonprofits taking a proactive approach to growth and impact.

From Survival to Strategic Growth

Right now, the nonprofit sector is experiencing something akin to a slow-moving crisis. Increasing demand, decreasing unrestricted funding, political threats to rights and services, and deep structural inequities are creating overwhelming challenges. But amidst this, there is also clarity: doing more alone isn’t always the best path forward.

In fact, many of the healthiest, most effective nonprofits realize that collaboration — not competition — can be the path to greater impact. As we wrote in an earlier post, Collaboration Tips for 800-Pound Gorillas, “large, well-resourced organizations often struggle to be good partners.” But when they do get it right — leading with humility, sharing power, and aligning on values — they can drive transformations that preserve vital services and extend their reach to new communities.

Today, more than ever, it’s time for the sector’s “800-pound gorillas” to flex not just their operational muscles, but their leadership and vision — by seeing mergers not as hostile takeovers, but as mission-driven lifelines.

What It Takes to Do It Well

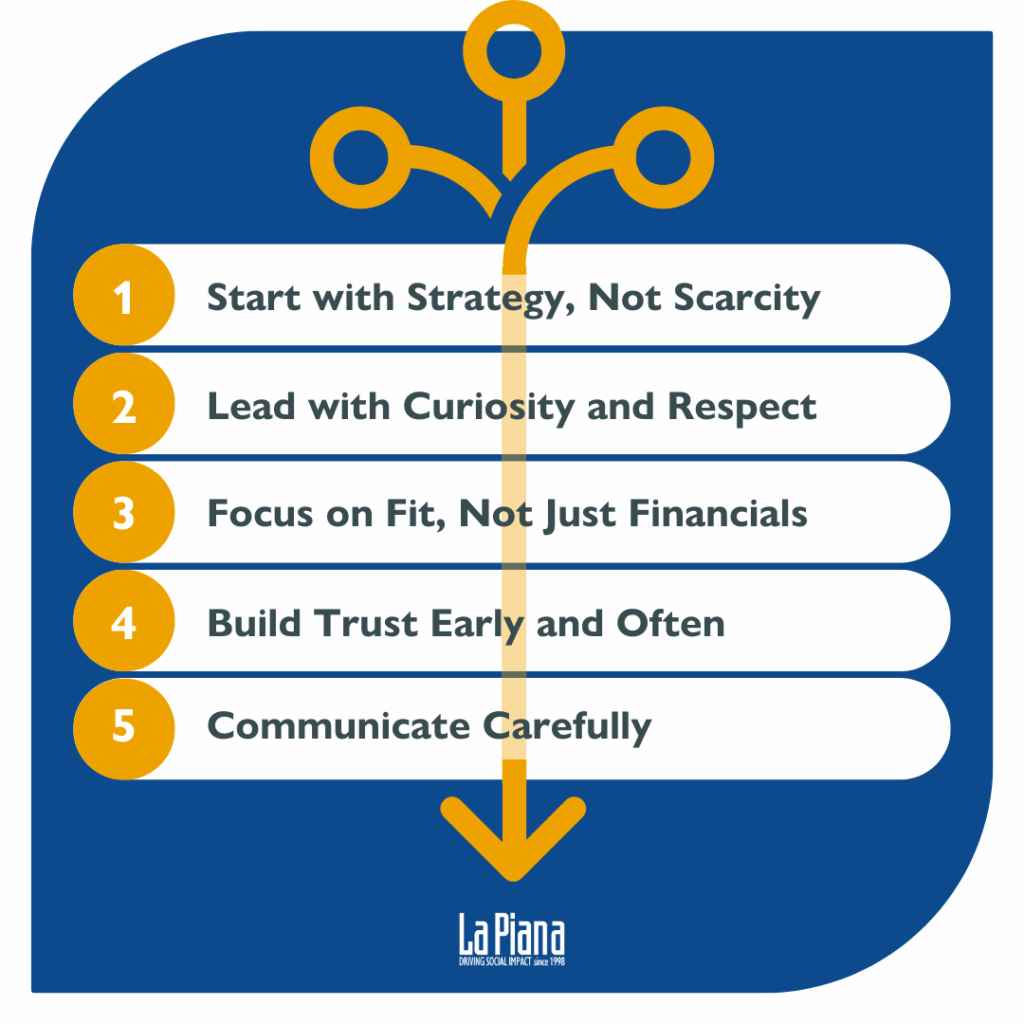

If you are a nonprofit leader considering growth through strategic merger, here are a few key insights from our decades of experience:

- Start with Strategy, Not Scarcity. Mergers are most successful when they are grounded in your strategic plan — not in knee-jerk responses to opportunities. What are your goals? Where do you want to go? What do you want to protect and expand?

- Lead with Curiosity and Respect. You may have more capacity, but your prospective partner has assets too: relationships, knowledge, cultural nuance, and trust. Approach every conversation as a peer-to-peer dialogue, not a power play or a rescue mission.

- Focus on Fit, Not Just Financials. Organizational culture, mission alignment, and leadership values are just as important as contract revenue and balance sheets. As we advise in our Merger & Alliance Toolkit, alignment is the number one success factor.

- Build Trust Early and Often. Mergers move at the speed of trust. Start with those you are already working with — those you already trust. Before you even initiate conversations with potential partners, invest in listening to funders, peers, and community leaders. Understand what’s happening on the ground and what’s at stake.

- Communicate Carefully. Messaging matters — especially in a sector built on relationships and community credibility. Develop shared talking points with your board and leadership team before any outreach.

The Moral Imperative

We are entering an era where the most dangerous risk for the nonprofit sector may be inaction. If healthy, growing organizations don’t take bold steps to integrate with and uplift struggling peers, many essential services may simply disappear.

This is not the time for mergers driven by ego or opportunism. It is the time for mission-led integration, for resource-sharing, and for bold, strategic combinations that ensure our sector’s infrastructure doesn’t just survive — but becomes more resilient, equitable, and future-ready.

Comment section